Understanding Constant Currency in Management Reporting

In the dynamic world of global finance, understanding and analysing financial performance across different countries and currencies can be a challenging endeavour. Constant currency reporting offers a powerful solution by eliminating the distorting effects of exchange rate fluctuations in financial data analysis.

This blogpost and downloadable detailed E-book (Download link at the end of the post) explores what constant currency calculation means, where it is used, its benefits, and potential risks. Historical Rate Method and Current Rate Method, the two most used calculation methods are presented in detail, providing a comprehensive understanding of this essential financial analysis tool.

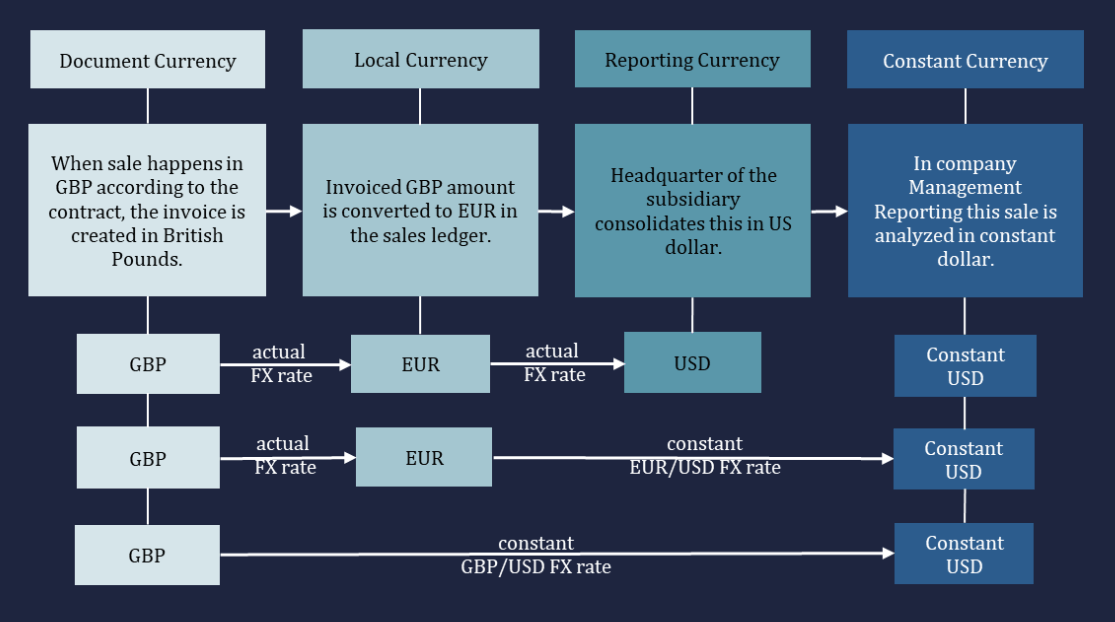

Understanding Constant Currency

Constant currency calculation is not recognized under any generally accepted accounting principle (GAAP); however, it is increasingly employed in management reporting within companies.

Benefits of Constant Currency Calculation

Constant currency reporting simplifies financial analysis by providing a consistent basis for comparison. This method allows businesses to assess genuine growth and operational performance without the noise of fluctuating exchange rates.

By presenting data that purely reflects operational outcomes, companies can better understand core business trends, make more informed strategic decisions, and provide clearer information to investors and stakeholders.

Providing constant currency figures:

- Allows for more accurate comparisons across different periods or geographic regions, making it easier to identify trends and patterns,

- Allows for better analysis and benchmarking of financial results, especially when evaluating multinational companies with diverse operations,

- Management evaluates its own performance on constant currency basis,

- Helps the company to show investors the power of the business.

Risks and Considerations

Implementing constant currency numbers in management reporting increases the complexity of the business reviews. Function leaders who don’t have finance background can be easily confused and misinterpret the numbers.

A not carefully chosen constant currency rate can:

- Mask or even show reverse business trends leading to wrong decisions.

- Sales and operating income converted into constant currency using prior year average exchange rate can result incorrect calculation due to seasonal numbers.

- Prior year weighted average constant currency rate calculated for revenue but also applied on expenses side results incorrect analysis.

Implementing Constant Currency Calculation in Management Reporting

The implementation of constant currency calculations in management reporting must be approached with care. Companies need to select the proper calculation method, determine an appropriate constant rate, and ensure that the method is applied consistently over time. Transparency is also vital; businesses must disclose their methodology and assumptions to allow stakeholders to understand how the figures were derived accurately.

Commonly Used Method of Constant Currency Calculation

Historical Rate Method

- In Period Comparison: Convert Current Period numbers using the Previous Period’s Average FX Rate. This shows what financial result would have been if the exchange rate remained unchanged.

- In Version Comparison: Recalculate later version, such as Actual numbers, with the FX Rate of the compared Previous Version, such as Budget or Forecast. This shows what the Actual financial result would have been if the exchange rate turned out as planned or forecasted.

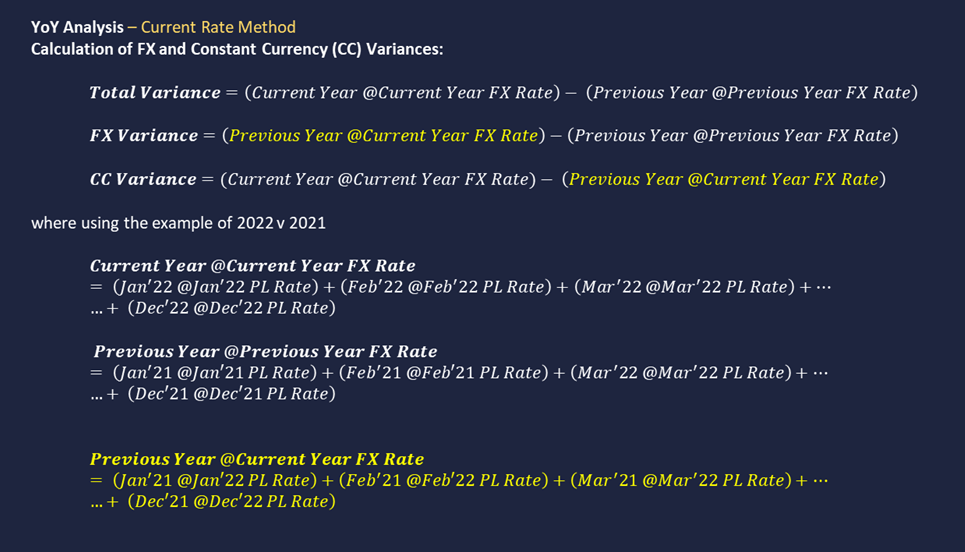

Current Rate Method:

- In Period Comparison: Calculate Previous Period numbers using the Current Period’s Average FX Rate. This shows what the financial result would have been in the previous period with the current exchange rate.

- In Version Comparison: Recalculate earlier version numbers with the FX Rate of the compared later version like Actual FX Rate. This shows what Budget or Forecast would have been if the actual exchange rate had been known.

Calculation differences of the two methods in detail though a YoY Period Comparison example

Download Our Free E-book on Constant Currency Calculations

For those looking to dive deeper into constant currency calculations, we invite you to download our comprehensive white paper. This resource provides an extensive exploration of constant currency methodologies and includes a case study demonstrating how these methods can be applied using actual financial data. By downloading the white paper, you’ll gain further insights into the nuances of period and version comparisons and understand better how to apply these strategies in your financial analysis.

Conclusion

Whether you rely on an Enterprise Resource Planning (ERP) system with built-in constant currency calculations or just plan to implement this calculation method in the Management Reporting system, understanding the underlying methodologies is essential. Whether you’re a financial analyst, investor, or business leader, understanding constant currency reporting is necessary for making informed decisions and accurately assessing business performance.

Enhance Your Financial Planning with Rapid Planner and Expert Support

Our FP&A solution is designed to simplify and automate enterprise grade financial planning and analysis. Equipped with seamless integration, built-in automations, and enhanced functionalities, Rapid Planner facilitates efficient financial operations. Handling constant currency calculations is just one of its many features, enabling precise and streamlined enterprise planning.

Facing challenges with financial planning? Our FP&A specialists are ready to offer tailored guidance and solutions to optimize your financial processes for accuracy and efficiency. Discover how our tools and expertise can transform your financial operations.